A crypto wallet is a tool that holds your private keys and allows you to interact with a blockchain. Crypto wallets come in several forms, ranging from software apps to hardware devices or even paper wallets.

Real-world wallets hold our cash, bank cards, and credentials. Crypto wallets work a bit differently, but there’s some overlap regarding credentials. A crypto wallet doesn’t store your digital assets as a real-world wallet would. The assets live on the blockchain.

Instead, the wallet stores the private keys that give you the authority to move those assets. If the blockchain is the global accounting system, the wallet is your interface for signing off on entries that belong to you. In a sense, the keys act as credentials that prove you own the blockchain assets.

Whether you use a mobile app, a browser extension, or a specialized hardware device, the wallet’s primary job is to manage your keys. Wallet apps also display your balance by reading the public ledger, and help you complete transactions.

How a Wallet Functions #

Every crypto wallet performs three core technical tasks that allow you to maintain digital sovereignty:

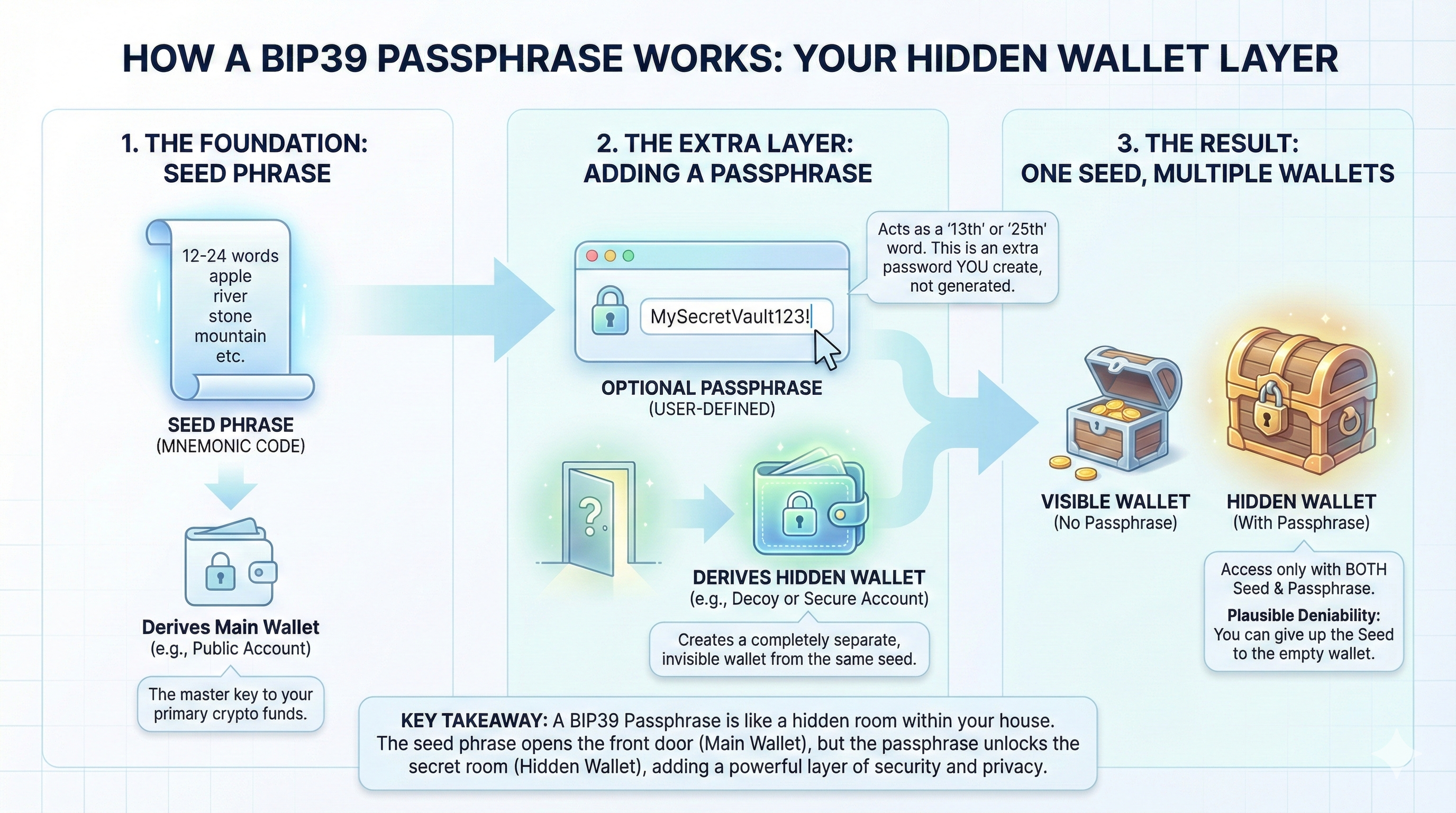

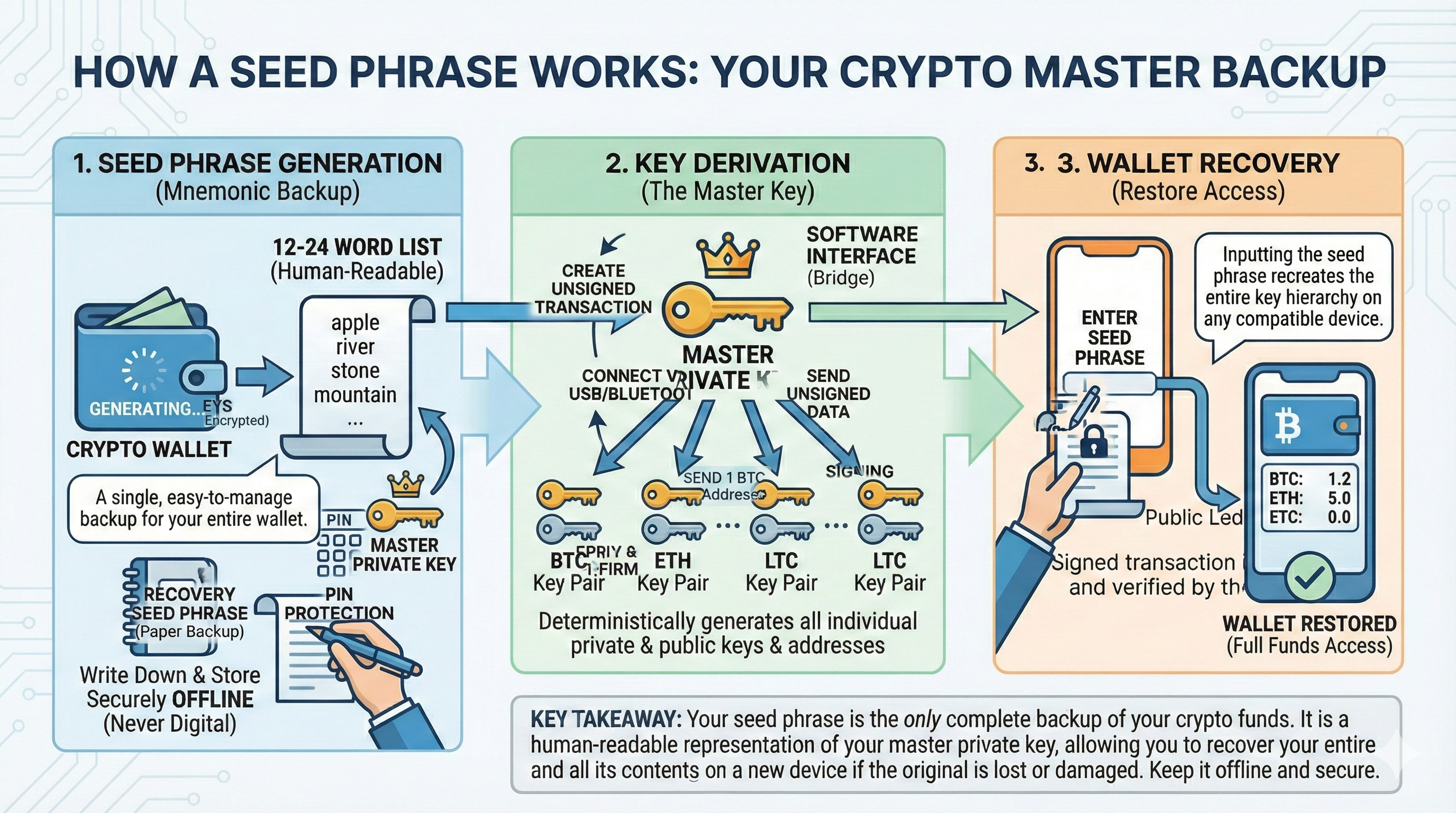

- Key Management: A wallet generates and stores your private key (for spending) and public key (for receiving). Most wallets use a seed phrase to generate the private keys (public keys are derived from private keys).

- Blockchain Interface: A crypto can view the blockchain for any transactions involving your public addresses. Some wallets even provide push alerts when you receive cryptocurrency or tokens.

- Transaction Signing: When you send funds, the wallet uses your private key to generate a cryptographic signature that proves you own the funds.

Why It Matters: Custodial vs. Non-Custodial #

The most important distinction in regard to wallets centers on who actually holds the keys. In a blockchain world where private keys prove ownership, who holds the keys matters. This choice determines whether you truly own your money or if you are simply an account holder at a digital bank.

- Non-Custodial Wallets (Sovereign): You hold the private keys. You have total control over your funds, but you also have total responsibility. If you misplace your Seed Phrase, no one can help you recover the assets. You are the bank.

- Custodial Wallets (Centralized): A third party (usually a crypto exchange ) holds the keys for you. You log in with a username and password to access your funds. While this is easier, you don’t actually own the assets; you have a claim against the exchange. If they go bankrupt or freeze your account, you lose access. This structure is very similar to a bank account, where customer deposits are liabilities for the bank.

You also have the option of using a hot wallet or cold storage. The distinction centers on whether the device on which the keys are generated and stored is connected to the internet.

- Hot wallets are connected to the internet (apps, extensions) for convenience.

- Cold wallets are kept offline and include hardware wallets, paper wallets, and always-offline wallet apps.

Wallet Forms and Formats #

Wallets come in various forms to address different risk profiles and priorities.

- Software Wallets: These are apps on your computer or mobile device. Wallet apps offer greater convenience for daily transactions, but they can also introduce additional risk. Stolen devices, bugs, or malware can put your blockchain assets in harm’s way.

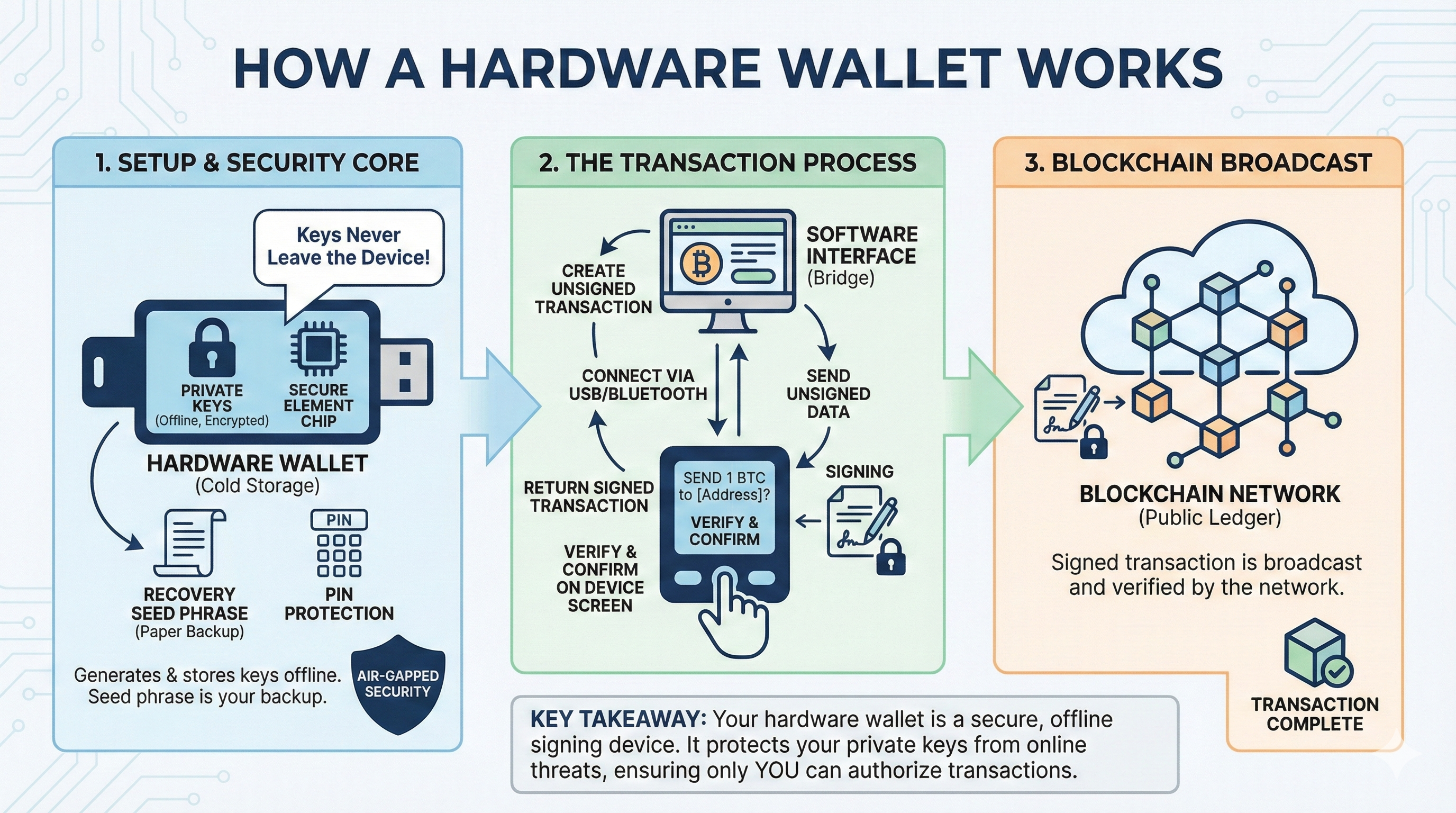

- Hardware Wallets: A crypto hardware wallet is a physical device that generates and stores the wallet’s keys offline. Hardware wallets are the gold standard for long-term savings. In many cases, hardware wallets can be paired with software wallets, allowing you to send, spend, and use blockchain apps while keeping your keys offline.

- Paper/Steel Wallets: Physical representations of your keys or seed phrase , used as a master backup. Notably, you can create a paper wallet without using a wallet app. However, use cases for this are rare and shouldn’t be attempted without first understanding the risks, such as why you shouldn’t use a “brain wallet.”

The Bottom Line #

A crypto wallet is your gateway to the world of independent finance. Your wallet turns your intentions into transactions. Alice can send Bitcoin to Bob using a Bitcoin wallet, and Carol can connect to a decentralized finance application with an Ethereum wallet. A crypto wallet holds keys (blockchain credentials), not assets. The keys prove you own the wallet and its associated blockchain assets.