A private key is an alphanumeric string that provides a signature that serves as proof of ownership for a specific blockchain wallet address. Users sign transactions that move assets or verify their pseudonymous identity on the blockchain using the unique private key for a given wallet address .

Typically a 256-bit string of numbers, the private key functions as a digital signature, proving to the network that the person (or smart contract ) requesting a transfer is the rightful owner of the funds. In the world of digital sovereignty, the private key is the only thing that matters; if you hold the key, you hold the assets.

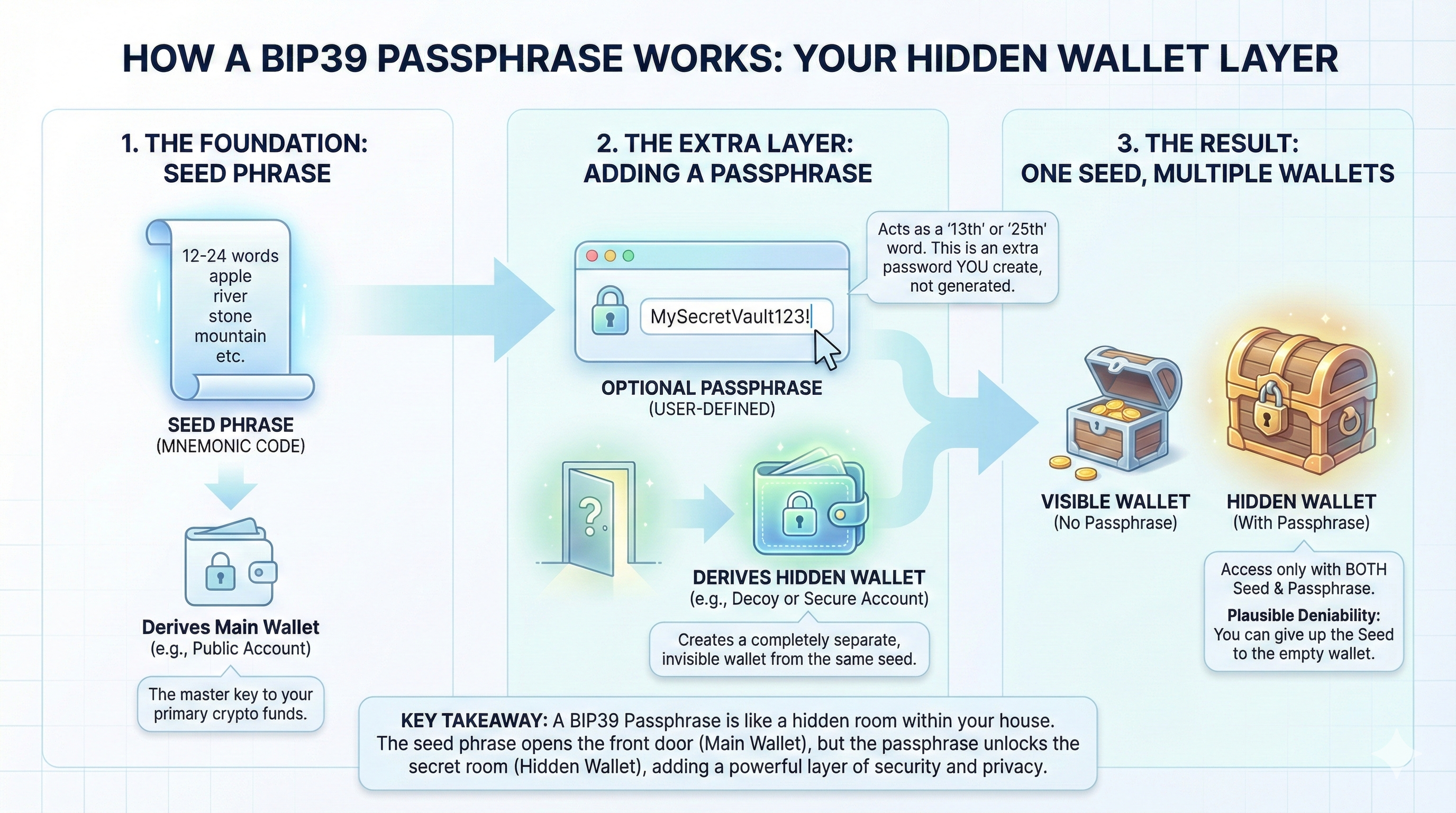

While we often interact with user-friendly seed phrases when setting up a wallet, they are just different versions of the underlying private keys. The wallet’s private keys (as well as its public keys and wallet addresses) are derived from the seed phrase. This makes the seed phrase a human-readable version of the less user-friendly private keys.

The key itself is the mathematical “lock” that secures your assets on the blockchain ledger . Nothing moves on the ledger without the key.

The One-Way Mathematical Door #

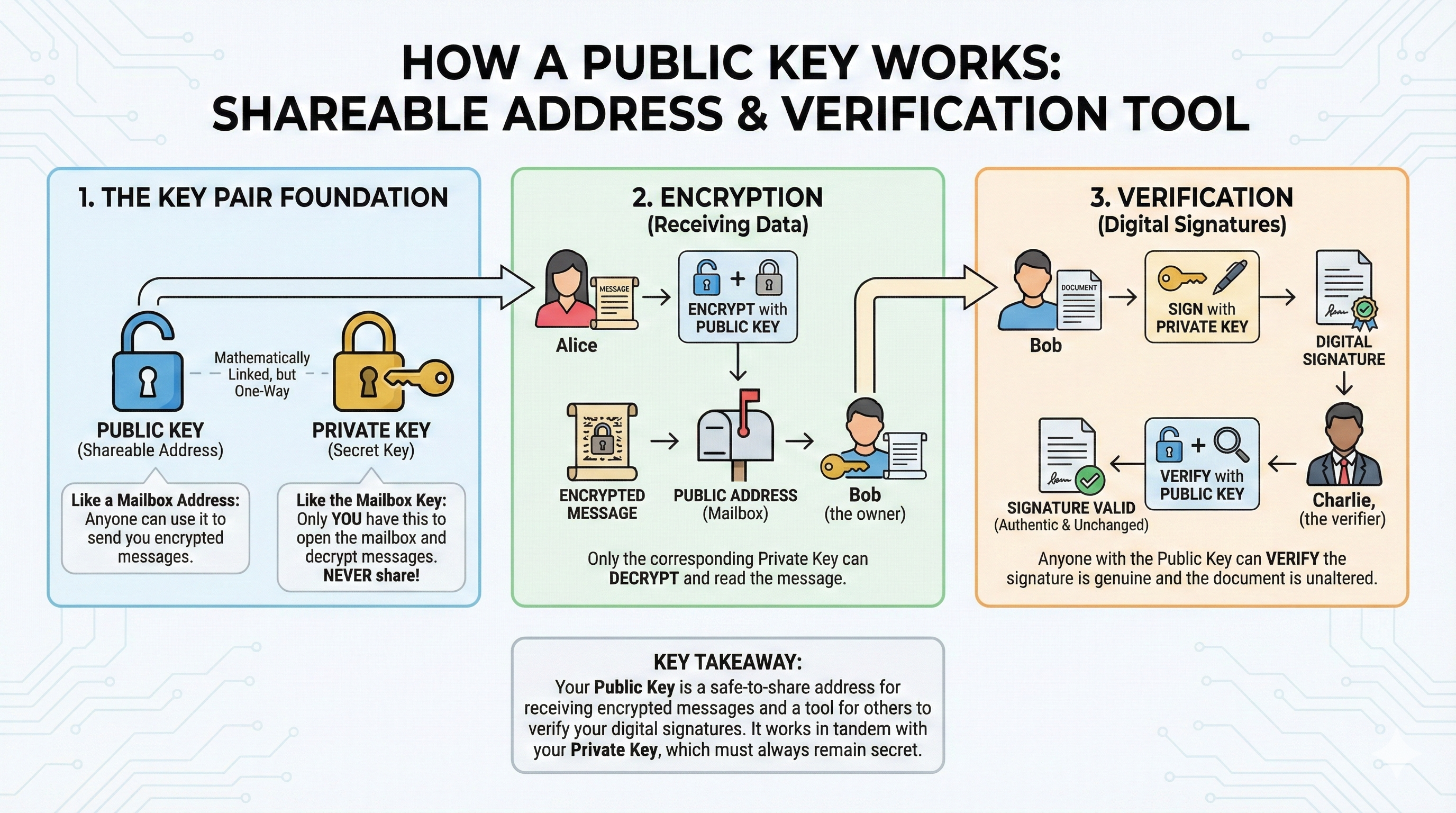

A private key’s security relies on Asymmetric Cryptography (one direction only). This allows a public key (your blockchain address) to be derived from your private key, but makes it mathematically impossible to reverse the process to find the secret private key.

- Digital Signatures: When you send assets, your wallet uses the private key for that specific wallet address to sign the transaction. The network verifies this signature matches your public address without ever needing to see the private key.

- Absolute Scarcity: A private key is a number between 1 and $2^{256}$. This range is so vast that, at a trillion guesses per second, the sun would burn out before all the possible keys could be checked. This makes it mathematically improbable for a computer to guess a key or for two people to ever generate the same key.

- Non-Custodial Power: Holding your own private keys is what differentiates a “Sovereign Individual” from a “Bank Customer.” When you hold the keys, you have the actual asset, not a promise of payment from a third party.

Why It Matters #

Understanding the nature of private keys changes how you approach every aspect of your digital security and storage strategy.

- Total Responsibility: Unlike a traditional bank account, there is no “Forgot Password” link. A lost seed phrase often means the funds are permanently locked on the blockchain. The blockchain also won’t confirm that you are the person using your key. Anyone with the wallet’s private key can access your blockchain assets. Protect your private key and seed phase. Don’t share these with anyone.

- Instant Portability: A private key is just information, so it’s not tied to a specific device. You can delete your wallet, travel across the world, and re-import the key into any compatible software to regain access to your wealth. The seed phrase offers similar recovery functionality.

- Censorship Resistance: Because you sign transactions locally before broadcasting them, no intermediary can easily freeze your ability to move your funds. As long as you have the key, you have the power to transact. However, there may be limits to this, such as token contracts with functions that can block transfers.

The Debrief #

A private key is the ultimate mathematical proof of ownership in the blockchain age. The key provides the final word on access to blockchain assets and serves as the bedrock of individual sovereignty. Protecting this key, primarily through the use of hardware wallets, is the single most important habit you can develop in the decentralized economy.